After quite a few years of change through the pandemic and rising interest rates, the first half of 2024 has seen a mostly stable commercial property market. But beneath that veneer of stability there are several important and interesting trends that anyone looking to build generational wealth through property investment should pay attention to.

Stable but High Interest Rates

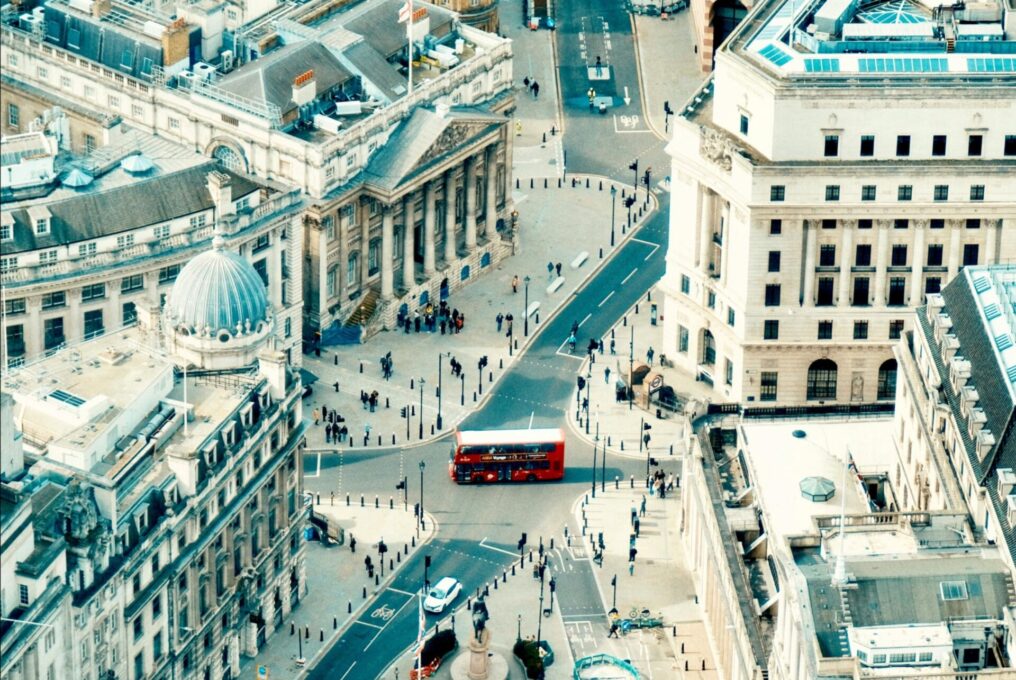

The sustained period of high interest rates has led to a somewhat cautious market, with potential investors hampered from purchasing property and sellers eager to hold onto assets rather than sell at a large discount. This trend is particularly evident in London’s commercial property market. According to property data group CoStar, there were no transactions exceeding £100 million in the City of London during the first half of the year. Given the lack of buyers, if you do have some capital some property is available right now that would usually be snapped up in a low interest rate environment.

WFH not going away, but differs a lot across the city

The WFH trend, which gained momentum during the pandemic, has generally stabilised. Office workers aren’t getting more days at home, and a lot are coming back into the office more. But we aren’t back to 2019 by any means.

WFH rates seem to vary a lot across the city. In central London, for example, the desirability of office spaces has become highly dependent on location and quality. Employees are willing to commute to prestigious and aesthetically appealing offices in the West End, where the vacancy rate was just 5.6% at the end of July, according to Knight Frank. This is especially the case as they can enjoy themselves at the theatre or in world-class restaurants in the West End after work. In contrast, the vacancy rate in Canary Wharf stood at 11% at the end of July, reflecting the reduced demand for glass boxes far away from other amenities.

This trend underscores a wider bifurcation in the market, where prime locations with desirable office environments are maintaining high occupancy levels, while less appealing areas struggle to attract tenants. Investors looking to capitalise on the commercial property market must carefully consider the location and appeal of potential investments. A London postcode isn’t quite enough.

Sustainability as a Key Driver of Demand

Today’s top tenants have serious climate change goals, and know that their buildings will go a long way to meeting them. This means properties that meet stringent climate targets are in high demand. Savills reports that over 55% of office rental take-up in the central London market in the first half of 2024 has been in buildings rated Outstanding or Excellent in the BREEAM standard.

This trend has led to more bifurcation in the market, where newer, greener buildings are enjoying stable rents and low vacancy rates, while older, less sustainable properties are finding it harder to compete. For investors, there are huge gains to be made in older buildings that can be brought up to standard with a capital injection.

Applying the Lessons of London to other cities

London is not alone as an incredible place to invest. The lessons of the city can be applied elsewhere.

Election could see London demand increase

The new government has signalled its intent to reform planning laws, aiming to stimulate growth and address the UK’s housing shortage. While these reforms may pave the way for increased construction in suburban and outer London areas, their impact on central London’s commercial property market is expected to be limited.

Labour Governments typically employ more civil servants than Conservative ones, so some increase in demand for top tier office space is likely over time. Already we’ve seen the new Government drop a Conservative plan to greatly reduce the headcount of the civil service.

Stability means this is a good time to invest

With high interest rates and worry about WFH trends keeping a lot of investors out of the market, those with some capital to invest can snap up some real bargains. This is especially the case if they have the money to bring these buildings up to a high sustainability standard, which will make them massively desirable to office tenants – particularly those in Government.